Have you ever found yourself in a situation where you urgently needed money sent from a loved one in another country? Perhaps a family member needed financial assistance during a medical emergency, or you had to send a down payment on a new house in a foreign country. In such times, relying on a trusted and efficient money transfer service like Western Union can be a lifesaver. But navigating the world of international money transfers, especially for the first time, can be confusing and overwhelming.

Image: www.pdfprof.com

This comprehensive guide aims to provide you with a detailed understanding of Western Union money transfers, from the moment you initiate a transfer to the moment you receive the money. By the end of this article, you will have a clear grasp of how Western Union works, the associated fees, and how to ensure a smooth and secure transaction.

Understanding Western Union: A Global Lifeline

Western Union is a global leader in money transfers and payment services, facilitating billions of dollars in transactions every year. Established in 1851, Western Union has built a network of over 500,000 agent locations in more than 200 countries and territories, making it one of the most accessible and widely used money transfer services worldwide. However, it’s important to understand how Western Union transfers work to make the most of the service.

Sending Money with Western Union: A Step-by-Step Guide

Sending money through Western Union is remarkably simple and can be done through various methods:

- Online: Visit the official Western Union website or mobile app (available on Android and iOS). You will need to create an account, provide the recipient’s information, and the amount you wish to send.

- Agent Location: Visit a Western Union agent location, which can range from a local convenience store to a bank or post office. You will need to provide the recipient’s information, the amount you want to send, and your payment details.

- Mobile Wallet: Some Western Union mobile wallet services allow you to send money directly from your phone, making it convenient for on-the-go transfers.

Essential Information for Sending:

- Recipient’s Name: Full name exactly as it appears on the recipient’s identification.

- Recipient’s Country: The country where the recipient will be receiving the money.

- Recipient’s City: The city or town where the recipient lives.

- Recipient’s Address: A complete and accurate address for location tracking and delivery.

- Amount to Send: The total amount you want to send, including any fees.

- Payment Method: You can pay with cash, debit card, or credit card.

Important Notes:

- Fees: Western Union charges fees for sending money, which vary depending on the amount sent, the destination country, and the chosen payment method. These fees can be calculated online on Western Union’s website.

- Exchange Rates: The exchange rate used for the transaction is determined by Western Union and can fluctuate depending on market conditions.

- Transfer Limits: Western Union has limits on how much money you can send, based on your account type, chosen payment method, and the destination country.

Receiving Money with Western Union: A Seamless Experience

Receiving a Western Union transfer is just as user-friendly as sending it. The recipient can collect the money in person at a Western Union agent location or have it deposited directly to their bank account:

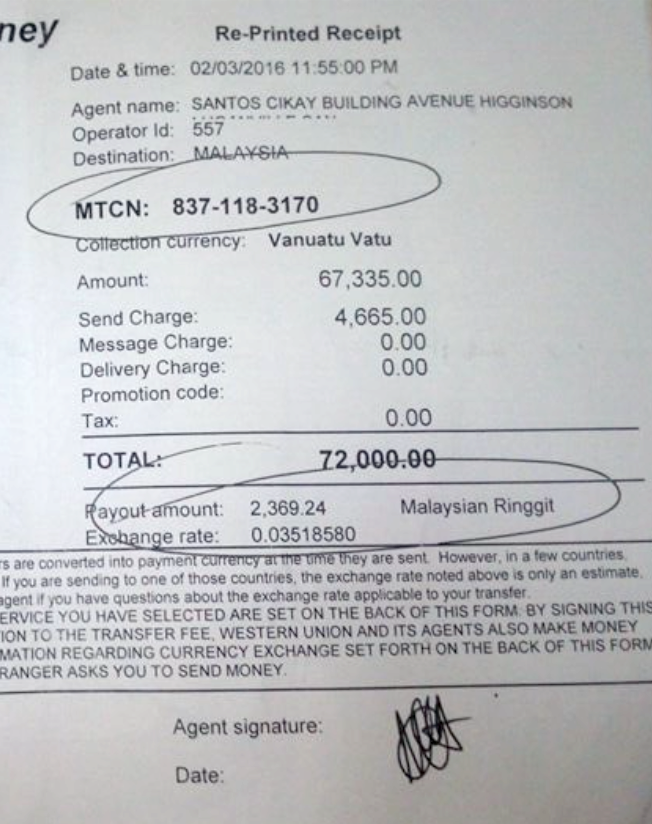

- Collecting at an Agent Location: The recipient will need to provide a valid identification document (like a passport or driver’s license), the Money Transfer Control Number (MTCN), and the sender’s name. They will receive the money in cash.

- Bank Deposit: The recipient can provide their bank account details, and Western Union will deposit the money directly into their bank account.

Important Notes:

- MTCN: The MTCN is a unique 10-digit code generated during the money transfer process. This number is essential for receiving the funds.

- Collection Timeframe: The time it takes for the recipient to collect the money depends on various factors, including the destination country and the chosen payment method.

- Currency Conversion: If the recipient is receiving money in a different currency than the sender sent it in, the funds will be converted at the prevailing exchange rate.

- Verification: Western Union may require additional personal information from the recipient to verify their identity and prevent fraud.

Image: www.scribd.com

Security and Safety of Western Union Transfers

Western Union ensures the security and safety of each transfer through multiple layers of protection:

- Encryption: Western Union uses advanced encryption protocols to protect sensitive financial information during the transaction process.

- Fraud Detection: Western Union has sophisticated systems in place to detect potential fraud and prevent unauthorized transfers.

- Customer Support: Western Union offers reliable customer support to assist you with any questions or concerns you might have about your transaction.

Factors Influencing the Cost of Western Union Transfers

Several factors contribute to the total cost of using Western Union’s services. Understanding these factors can help you make informed choices and save money on your transfers:

- Amount Sent: The larger the amount of money you send, the lower the percentage-based fee is likely to be.

- Destination Country: Fees can vary significantly depending on the destination country.

- Payment Method: Paying with a debit card or credit card often incurs higher fees than paying in cash.

- Transfer Method: Sending money online is usually cheaper than sending it through an agent location.

- Exchange Rates: Fluctuations in exchange rates can affect the total cost of the transfer.

Alternative Money Transfer Services: Expanding Your Options

While Western Union undoubtedly holds a dominant position in the money transfer market, several other reliable options can meet your needs:

- MoneyGram: A direct competitor to Western Union, MoneyGram offers comparable features and a wide network of agent locations.

- WorldRemit: An online money transfer service that offers competitive exchange rates and low fees.

- Azimo: Another online service specializing in global money transfers, known for speed and low fees.

- Wise (formerly TransferWise): A popular choice for international money transfers, known for its transparent pricing and competitive exchange rates.

Choosing the Right Service:

Before choosing a money transfer service, it’s crucial to compare fees, exchange rates, and the available payment methods. Consider factors like the speed of transfer, the destination country, and any specific requirements or preferences you may have.

Embracing the Future of Western Union: Digital Innovation

Western Union is constantly adapting to the evolving digital landscape, introducing innovative features to enhance your experience:

- Digital Transactions: Western Union’s online and mobile apps offer a secure and user-friendly platform for initiating and tracking transfers.

- Mobile Wallets: Western Union has partnered with various mobile wallet providers, allowing you to send and receive money directly through your mobile device.

- Blockchain Integration: Western Union is exploring the potential of blockchain technology to enhance the speed, security, and transparency of its transactions.

FAQs About Western Union Transfers

Q: How long does it typically take for a Western Union transfer to reach the recipient?

A: The transfer time varies depending on the destination country and the chosen payment method. In many cases, money can be received within minutes. However, transfers to certain countries can take longer, up to several business days.

Q: Are there any restrictions on the amount of money I can send?

A: Yes, Western Union has limits on the amount of money you can send, based on your account type, the chosen payment method, and the destination country. These limits can be found on Western Union’s website.

Q: Can I track the status of my money transfer?

A: Yes, you can track the status of your transfer online or through the Western Union mobile app. You will receive updates on the progress of your transfer, including when it is delivered to the recipient.

Q: What happens if I make an error in the recipient’s information?

A: If you have provided incorrect recipient information, you should contact Western Union customer support immediately. They may be able to correct the information or refund the money to you.

Q: Is Western Union safe and secure?

A: Western Union prioritizes the security of its transactions. They use advanced encryption technologies to protect your financial information and have fraud detection systems in place to prevent unauthorized transfers.

Receipt Of Western Union Money Transfer

Conclusion

Western Union remains a reliable and convenient option for transferring money across borders. By understanding the process, fees, and security measures involved, you can ensure a smooth and secure transaction. Whether you need to send money to a loved one abroad, pay for goods or services, or simply access your funds in a foreign country, Western Union provides a trusted and efficient solution.

As the world becomes increasingly interconnected, the need for convenient and secure money transfer services is greater than ever. Western Union continues to evolve alongside this demand, leveraging digital innovation to provide a seamless and user-friendly experience. Don’t hesitate to reach out to Western Union Customer Support if you have any questions or need assistance with your transaction.