Have you ever moved and forgotten to update your credit report with your new address? Or maybe you’re dealing with the lingering effects of an old and embarrassing address associated with your past. Whatever the reason, knowing how to remove an old address from your credit report is a crucial step in maintaining your financial privacy and security. It can be a daunting process, but this comprehensive guide will empower you with all the information you need to get started.

Image: josephhumphries.z13.web.core.windows.net

Imagine a world where your credit report is perfectly accurate, reflecting your present-day reality. That’s the peace of mind you can achieve by confidently requesting the removal of an old address. It’s more than just a technicality – it’s about safeguarding your financial future and ensuring that your credit history paints an accurate picture of who you are today.

The Importance of an Accurate Credit Report

Your credit report is a vital document that impacts your ability to secure loans, credit cards, and even rental properties. It’s a financial snapshot of your past behavior, including your payment history, credit utilization, and the accounts you’ve opened. An outdated address can negatively impact your credit report in several ways:

- Identity theft: If a scammer has access to your old address, they could use it to open new accounts in your name or even file fraudulent tax returns.

- Lost mail: Important financial documents like credit card statements or loan information might get sent to your old address, making it difficult to track your finances.

- Negative credit impact: Some lenders may view an old address as a sign of instability, potentially affecting your credit score and loan approval odds.

Understanding the Process of Removing an Old Address

The process of removing an old address from your credit report typically involves contacting the three major credit bureaus: Experian, Equifax, and TransUnion. Here’s a breakdown of the steps to take:

1. Request a Credit Report:

- Request your credit report for free from each credit bureau, which you can do annually through AnnualCreditReport.com.

- Carefully review your reports and identify any outdated addresses.

2. Prepare Your Dispute Letter:

- Write a clear and concise dispute letter to each credit bureau.

- Include your full legal name, current address, Social Security number, and account information associated with the old address.

- Specifically request that they remove the old and incorrect address from your report.

- Be sure to cite the Fair Credit Reporting Act (FCRA) as the legal basis for your dispute.

3. Submit Your Dispute:

- Send your dispute letter by certified mail with return receipt requested. This way, you have proof of delivery.

- You can also submit your dispute online or through the credit bureau’s phone line.

4. Monitor Your Credit Report:

- After submitting your dispute, monitor your credit report to make sure the outdated address has been removed. This can take up to 30 days.

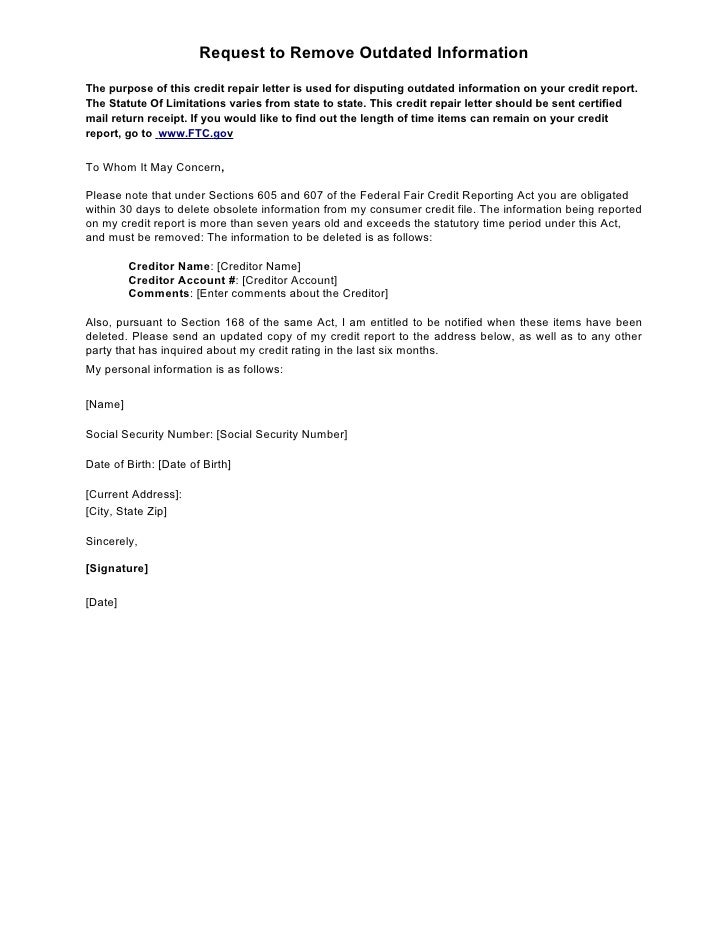

Sample Letter to Remove an Old Address from Your Credit Report

Here is a sample dispute letter that you can adapt for your own situation:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

Credit Reporting Agency

[Address]

Re: Dispute of Address Information

Dear [Credit Reporting Agency],

I am writing to dispute an incorrect address on my credit report. My account number is [account number]. The incorrect address listed is [old address].

My correct and current address is [your current address]. I request that you remove the incorrect address from my credit report immediately. You are required to investigate and respond to my dispute within 30 days of receipt.

I have reviewed my credit report and can confirm that I have not lived at [old address] since [date]. I am relying on the Fair Credit Reporting Act (FCRA) to guide your investigation and resolution of this matter.

Please note that I have enclosed a copy of [proof of your current address] with this letter.

Sincerely,

[Your Signature]

[Your Typed Name]

Important Tips for Writing Your Letter:

- Be precise and specific: Clearly identify the address you want removed and provide as much detail as possible about your current address.

- Be polite but assertive: While you should remain respectful, clearly state your intention to have the address removed.

- Provide evidence: If possible, enclose a copy of your current driver’s license, utility bill, or other documents verifying your current address.

Image: www.pdffiller.com

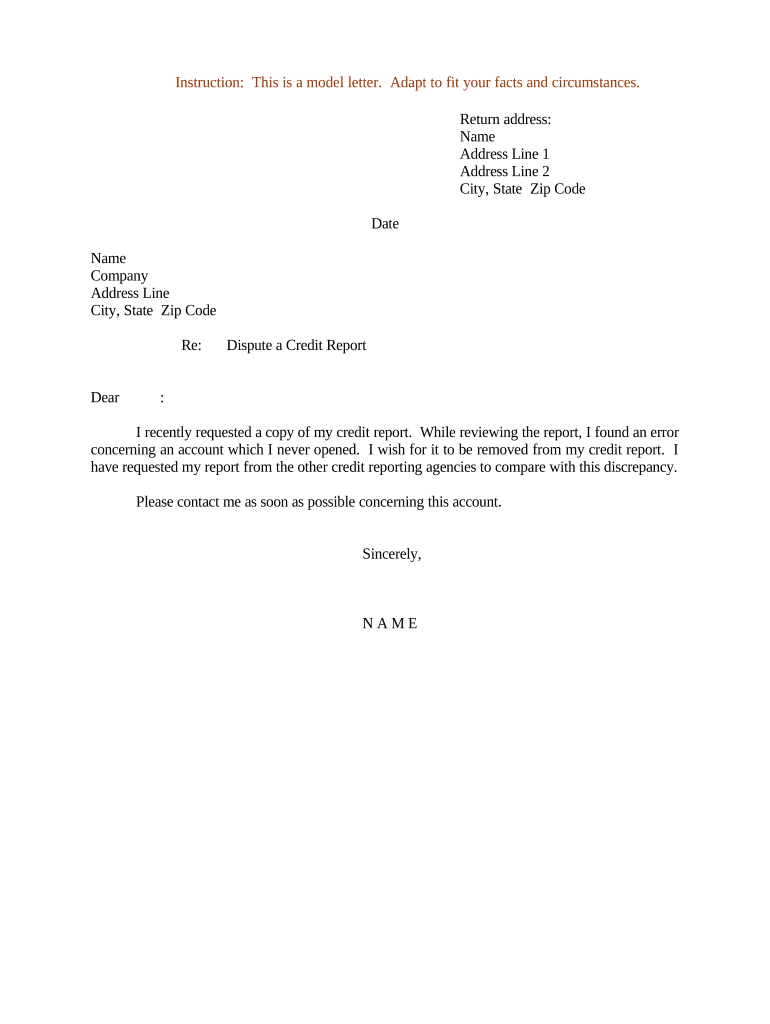

Expert Advice for Successful Address Removal

“It’s crucial to understand that your rights are protected under the Fair Credit Reporting Act (FCRA),” explains financial expert, [Name of Financial Expert]. “Make sure you cite this law in your dispute letter and keep copies of all correspondence with the credit bureaus.”

Additional Tips from Experts:

- Contact the credit bureau directly: If you encounter challenges removing the old address online, don’t hesitate to contact the agency directly by phone.

- Consider a credit monitoring service: To keep a close eye on your credit report and detect potential errors, consider signing up for a credit monitoring service.

- Consult with an attorney: If your dispute is ongoing or you face challenges, consulting with a lawyer knowledgeable in credit reporting laws may be beneficial.

Sample Letter To Remove Old Address From Credit Report

Closing Thoughts

Ensuring that your credit report accurately reflects your current situation is essential for maintaining your financial health. By taking the steps outlined in this guide, you can successfully remove an old address and protect your credit score. Remember, an accurate credit report empowers you to achieve your financial goals and build a secure financial future.

Take action today and start the process of cleaning up your credit report. Your peace of mind and financial well-being are worth the effort. Don’t hesitate to share your experience with others and let them know how you successfully removed an old address from your report. Empowering others is a valuable part of safeguarding everyone’s financial security.