Ever wondered where all your money goes? We’ve all been there. Whether you’re meticulously tracking your budget or trying to piece together a forgotten purchase, having a clear record of your financial transactions is invaluable. That’s where Bank of America Transaction History PDFs come in, offering a comprehensive, downloadable snapshot of your banking activities.

Image: www.reddit.com

This article delves into the world of Bank of America transaction history PDFs, explaining how to access them, what information they contain, and how you can utilize them to your advantage. Whether you’re a seasoned financial planner or just starting to understand your finances, this guide will equip you with the knowledge to leverage this powerful tool effectively.

What are Bank of America Transaction History PDFs?

Bank of America Transaction History PDFs are digital summaries of all your transactions associated with a particular account. Think of them as a chronological ledger, capturing details like:

- Date and time of the transaction

- Description of the transaction (e.g., “Grocery Store Purchase,” “Online Payment”)

- Amount of the transaction

- Transaction type (credit, debit, transfer, ATM withdrawal)

- Account balance after the transaction

These PDFs are readily available through the Bank of America website and mobile app, allowing you to access your transaction history anytime, anywhere.

How to Access Your Bank of America Transaction History PDF

Obtaining your Bank of America Transaction History PDF is a straightforward process. Here’s a step-by-step guide:

1. Log in to Online Banking

Head to the Bank of America website and log into your online banking account using your user ID and password.

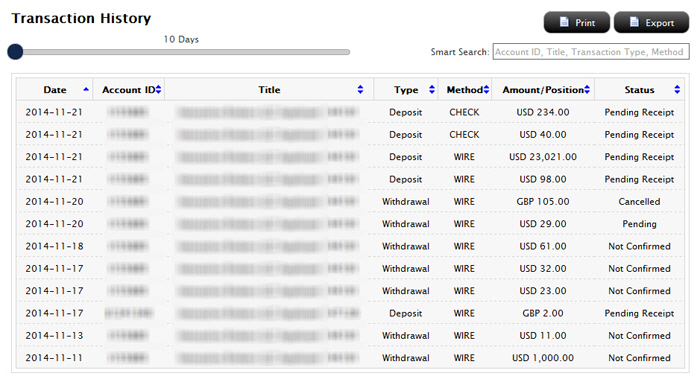

Image: www.interactivebrokers.com

2. Navigate to “Account Activity”

Once you’re logged in, locate the “Account Activity” section within your online banking dashboard. You can often find this by selecting the specific account you wish to review.

3. Select the Desired Time Period

Bank of America offers a range of options for customizing your transaction history. You can select a specific date, period (e.g., last month, past three months), or a custom date range. This allows you to target the information you need most.

4. Choose “Download as PDF”

Once you’ve chosen your desired time frame, you’ll typically see options for exporting your data. Look for the button that says “Download as PDF.”

5. Save the PDF

After clicking the “Download as PDF” button, your transaction history will be downloaded to your computer as a PDF file. You can then save this file to your preferred location.

Benefits of Using Bank of America Transaction History PDFs

The ability to download your transaction history in PDF format offers a wealth of benefits, both for personal finance and for various other needs.

1. Budgeting and Financial Planning

Perhaps the most critical application of transaction history PDFs is in budgeting and financial planning. By analyzing your spending patterns, you can identify areas of overspending, adjust your budget accordingly, and make informed financial decisions.

2. Tracking Expenses

Tracking down the source of a specific expense has never been easier. With the detailed information provided in your transaction history, you can quickly pinpoint where your money went and ensure accurate record-keeping.

3. Reconciling Account Statements

The PDF format ensures the accuracy of your transactions and makes reconciling account statements a breeze. You can easily compare your statement to your transaction history to identify any discrepancies and prevent potential errors.

4. Tax Preparation

When tax season arrives, having a consolidated PDF of your transaction history can be a lifesaver. You can easily identify deductible expenses, simplify your income reporting, and ensure accurate tax returns.

5. Proving Transactions

Sometimes, you may need to prove a transaction, whether for a refund, a claim, or other purposes. A Bank of America Transaction History PDF serves as official documentation, providing a verifiable record of your financial activities.

Going Beyond the Basics: Advanced Uses of Transaction History PDFs

While the benefits listed above are invaluable for personal finance, Bank of America Transaction History PDFs have applications that extend beyond budgeting and expense tracking. They can be utilized for:

1. Financial Analysis and Reporting

By leveraging the information in these PDFs, financial analysts and advisors can gain insights into spending habits, track investment performance, and provide customized financial advice.

2. Research and Data Mining

Researchers and data scientists can use transaction history data to analyze consumer behavior, identify market trends, and develop economic models.

3. Forensic Accounting

In forensic accounting investigations, transaction history PDFs can be crucial evidence, helping to uncover fraudulent activities, identify missing funds, and analyze financial irregularities.

Tips for Maximizing Your Bank of America Transaction History PDFs

To get the most out of your Bank of America Transaction History PDFs, consider the following tips:

1. Organize Your Files

Maintain a consistent naming convention for your PDFs, such as “BOA-Transaction-History-2023-04-01-2023-04-30.” This will help you easily locate the specific files you need.

2. Utilize Search Functionality

Most PDF viewers offer search functionality. Take advantage of this by searching for keywords like specific vendors, transaction amounts, or transaction types to find what you’re looking for quickly.

3. Consider a Financial Management App

Many popular financial management apps, such as Mint, Personal Capital, and YNAB, allow you to import your transaction history PDFs. This can automate data analysis, provide personalized insights, and connect your spending habits with your budget goals.

Security and Privacy Considerations

Bank of America prioritizes the security and privacy of your financial data. It’s essential to exercise caution when handling your transaction history PDFs:

- Protect Your Password: Keep your online banking password secure and avoid sharing it with anyone.

- Strong Passwords: Use a combination of uppercase and lowercase letters, numbers, and symbols for a robust password.

- Two-Factor Authentication: Enable two-factor authentication for an extra layer of security.

- Secure Storage: Store your PDFs in encrypted folders, password-protected archives, or cloud storage services with robust security measures.

- Beware of Phishing: Be cautious of suspicious emails, phone calls, or websites requesting sensitive financial information.

Bank Of America Transaction History Pdf

https://youtube.com/watch?v=k55NEqogzgU

Conclusion

Bank of America Transaction History PDFs are a valuable tool for understanding and managing your finances. From budgeting and expense tracking to tax preparation and financial analysis, these PDFs offer a wealth of benefits. By utilizing them effectively and prioritizing security and privacy, you can gain unprecedented control over your financial well-being. Remember, knowledge is power, and with access to your transactional information, you’re equipped to make informed decisions and take control of your financial future.