Imagine this: You’ve been diligently paying your insurance premiums for years, but now you find yourself needing to cancel your policy. Whether it’s due to a change in circumstances, finding a better deal, or simply no longer requiring coverage, the process can feel daunting. You find yourself staring at a blank screen, unsure of what to write or how to ensure your request is handled professionally.

Image: jackeesuperstar.blogspot.com

This is where understanding the art of insurance policy cancellation letters comes into play. These letters act as formal communication channels, allowing you to clearly articulate your intent to cancel your policy while adhering to the legal and contractual requirements set by your insurance provider. In this comprehensive guide, we’ll delve into the intricacies of cancellation letter templates, providing you with valuable insights, practical tips, and essential information to navigate this process with confidence.

Understanding the Importance of a Well-Crafted Cancellation Letter

A cancellation letter isn’t just a formality; it’s a crucial document that safeguards your rights and ensures a smooth transition from your current insurance policy. Here’s why a well-written letter is paramount:

– Clear Communication: A well-structured cancellation letter eliminates any ambiguity regarding your intention to terminate your policy, leaving no room for misunderstandings or disputes.

– Documentation: It serves as a written record of your request, providing irrefutable evidence of your actions in case of future discrepancies or claims.

– Compliance with Legal Requirements: Some insurance policies may specify specific procedures for cancellation, which your letter must adhere to, preventing any legal complications.

– Avoiding Penalties: Failing to follow the correct cancellation process could lead to unexpected charges, penalties, or coverage gaps.

Essential Components of a Cancellation Letter

A solid cancellation letter should contain the following vital elements:

1. Your Contact Information: Start by providing your complete name, address, phone number, and email address.

2. Your Insurance Policy Details: Include your policy number, type of insurance coverage (e.g., auto, health, home), and the name of your insurance company.

3. Cancellation Date: Clearly specify the date on which you wish your insurance policy to be cancelled. It’s crucial to be aware of the notice period required by your insurance provider, as your cancellation date should align with these regulations.

4. Reason for Cancellation: Briefly and clearly state the reason for your decision to cancel. This could be a change in your circumstances, finding a more affordable policy, or simply no longer needing the coverage.

5. Confirmation of Premium Payment: If you’re cancelling your policy before the end of your premium payment cycle, ensure you explicitly state whether you expect a refund for any remaining payments.

6. Your Signature and Date: Conclude your letter with your handwritten signature and the current date.

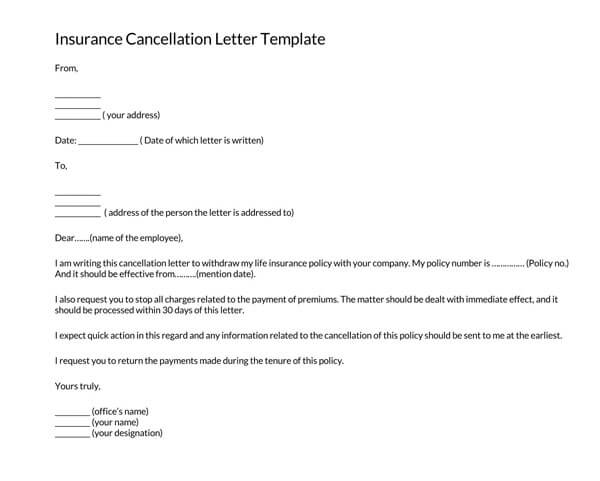

Example Cancellation Letter Template:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email]

[Date]

[Insurance Company Name]

[Insurance Company Address]

Subject: Cancellation of Insurance Policy – Policy Number [Your Policy Number]

Dear [Insurance Company Representative Name],

This letter is to formally request the cancellation of my insurance policy, policy number [Your Policy Number], effective [Cancellation Date].

[Reason for Cancellation] (For example: I am cancelling this policy due to [reason].)

I would appreciate it if you could confirm receipt of this cancellation request and provide me with any relevant information regarding policy termination, including any remaining premium payments or applicable refunds.

Thank you for your attention to this matter.

Sincerely,

[Your Signature]

[Your Typed Name]

Beyond the Basic Template: Considerations for Different Circumstances

While the template above provides a solid foundation, you might need to make adjustments based on your specific situation. Here are some common scenarios and additional considerations:

1. Early Cancellation: If you’re terminating your policy before the end of your premium payment cycle, emphasize your request for a refund for any remaining payments. Include the specific amount or calculation of the refund you believe you’re entitled to.

2. Existing Claims: If you have an outstanding claim, inform your insurance provider in detail about the status of the claim. State how you wish the claim to be handled after the cancellation of your policy.

3. Specific Policy Details: Some policies may have unique cancellation requirements, such as specific forms to be filled out or processes to be followed. Carefully review your policy documents to ensure your cancellation letter complies with all terms.

4. Confirmation of Cancellation: After submitting your letter, request written confirmation from your insurance company acknowledging receipt of your request and confirming the cancellation date. This serves as valuable documentation and protects you from any future disputes.

Image: www.wordlayouts.com

Expert Advice: Maximizing Your Success

Here are some insightful tips from insurance professionals to ensure your cancellation process goes smoothly:

1. Consult Your Policy: Before drafting your letter, carefully review your insurance policy documents to understand any specific cancellation procedures, requirements, and potential fees.

2. Contact Customer Service: While a formal letter is necessary, it’s a good practice to also contact your insurance company’s customer service department to inform them of your intent to cancel and inquire about any specific procedures.

3. Double-Check for Accuracy: Thoroughly proofread your cancellation letter to ensure all contact information, policy details, and dates are accurate. Mistakes can lead to delays and complications.

4. Keep a Copy: Always retain a copy of your cancellation letter for your records. This ensures you have evidence of your request in case of any issues later on.

Cancellation Of Insurance Policy Letter Template

Empowering Yourself with Knowledge

Understanding the intricacies of insurance policy cancellation empowers you as a consumer. By crafting a well-structured and informative letter, you’ll navigate this process with confidence and ensure a smooth transition. Remember, seeking professional guidance or legal advice when needed is always advisable, especially in complex situations. By being proactive and informed, you take control of your insurance journey and safeguard your rights.

Call to Action: Have you ever had to cancel an insurance policy? Share your experience and tips in the comments below to help others navigate this important process.