Imagine a bustling marketplace, filled with vibrant colors, enticing scents, and the sound of eager shoppers. Each sale, each transaction, signifies a heartbeat, a pulse of life for the businesses operating within this vibrant ecosystem. But what fuels this energy? What allows these businesses to thrive, to grow, and to continue serving their customers? The answer lies in the revenue account, the core engine that drives every merchandising operation.

Image: www.chegg.com

Understanding the revenue account is not just about balancing ledgers and crunching numbers; it’s about grasping the very essence of a merchandising business. It’s about recognizing how every sale, every product, contributes to the overall financial health and future of the company. This article delves deep into the intricacies of the revenue account, providing a comprehensive understanding of its role, impact, and significance in the world of merchandising.

The Revenue Account: A Foundation Built on Sales

The revenue account is the heart of a merchandising business’s financial reporting. It embodies the total value of goods sold during a specific period, typically a month, quarter, or year. For a merchandising company, this revenue is earned directly through the sale of tangible products, in stark contrast to a service-based business that derives its revenue from the delivery of intangible services.

The revenue account isn’t just a static figure; it’s a dynamic reflection of the company’s performance. Every sale, every transaction, contributes to its growth, reflecting the success of the company’s marketing, sales, and inventory management strategies.

The ABCs of Revenue Recognition

Imagine a store selling a beautifully crafted wooden toy. How does this sale translate into revenue? Understanding the principles of revenue recognition is crucial for accurately tracking and reporting revenue. The core principle dictates that revenue is recognized when it is earned and realized.

- Earned: The business has completed the performance obligation, meaning it has delivered the goods or services for which payment is expected. In the case of the toy, the business has delivered the toy to the customer.

- Realized: The business has received the payment or has a reasonable assurance of collecting the payment. This usually involves the customer actually paying for the toy.

Decoding the Revenue Account: A Closer Look

While the revenue account captures the total income from sales, a deeper analysis can reveal valuable insights. Merchandisers often break down revenue into various categories, providing a more granular view of their business:

- Product Revenue: This represents the majority of revenue for a merchandising business and reflects sales of the core products.

- Service Revenue: Some merchandising businesses offer additional services, like installation or delivery, which generate service revenue.

- Returns and Allowances: When customers return defective or unwanted products, or receive discounts, these deductions are reflected in the revenue account.

Image: connorcoleman.z13.web.core.windows.net

Revenue Recognition Methods: Navigating the Accounting Maze

Accounting standards provide various methods for recognizing revenue. The specific method employed depends on the nature of the merchandising business and its transactions. Here are some of the key methods:

- Point-of-Sale Method: This method is commonly used for merchandise sold immediately. Revenue is recognized as soon as the sale occurs, with payment typically received at the time of purchase. Think of a bookstore selling a book to a customer.

- Accrual Method: This method recognizes revenue when the sale is completed, even if payment isn’t immediately received. For example, a furniture store selling a sofa on credit would use this method.

- Percentage-of-Completion Method: Used for long-term projects, revenue is recognized in stages as parts of the project are completed.

Maximizing Revenue: Strategic Insights for Growth

The revenue account is not just a measure of past performance; it’s a blueprint for future success. Merchandisers can leverage their revenue data to identify growth opportunities and make informed decisions. Some key strategies include:

- Market Research and Product Development: Analyze sales trends to identify popular products and consumer preferences. Invest in research and development to introduce new products that meet unmet needs.

- Pricing Strategies: Consider factors like competition, costs, and consumer demand when setting prices. Implement dynamic pricing strategies to maximize revenue and profit.

- Promotional Campaigns and Marketing Efforts: Utilize marketing channels to attract new customers and increase sales. Evaluate the effectiveness of promotional campaigns to optimize marketing spend.

- Sales Force Management: Invest in training and development for sales personnel to enhance their skills and drive sales. Implement performance-based incentives to motivate team members.

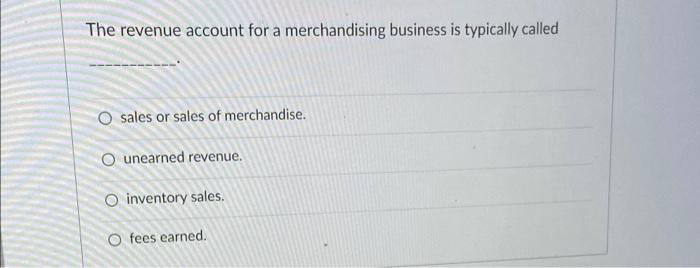

Generally The Revenue Account For A Merchandising Business Is Entitled

The Value of Understanding the Revenue Account

The revenue account is the linchpin of a merchandising business. It provides a clear picture of a company’s financial health, enabling informed decision-making and strategic planning. By understanding the principles of revenue recognition, analyzing revenue data, and implementing effective growth strategies, merchandisers can maximize their revenue and build thriving, sustainable businesses.