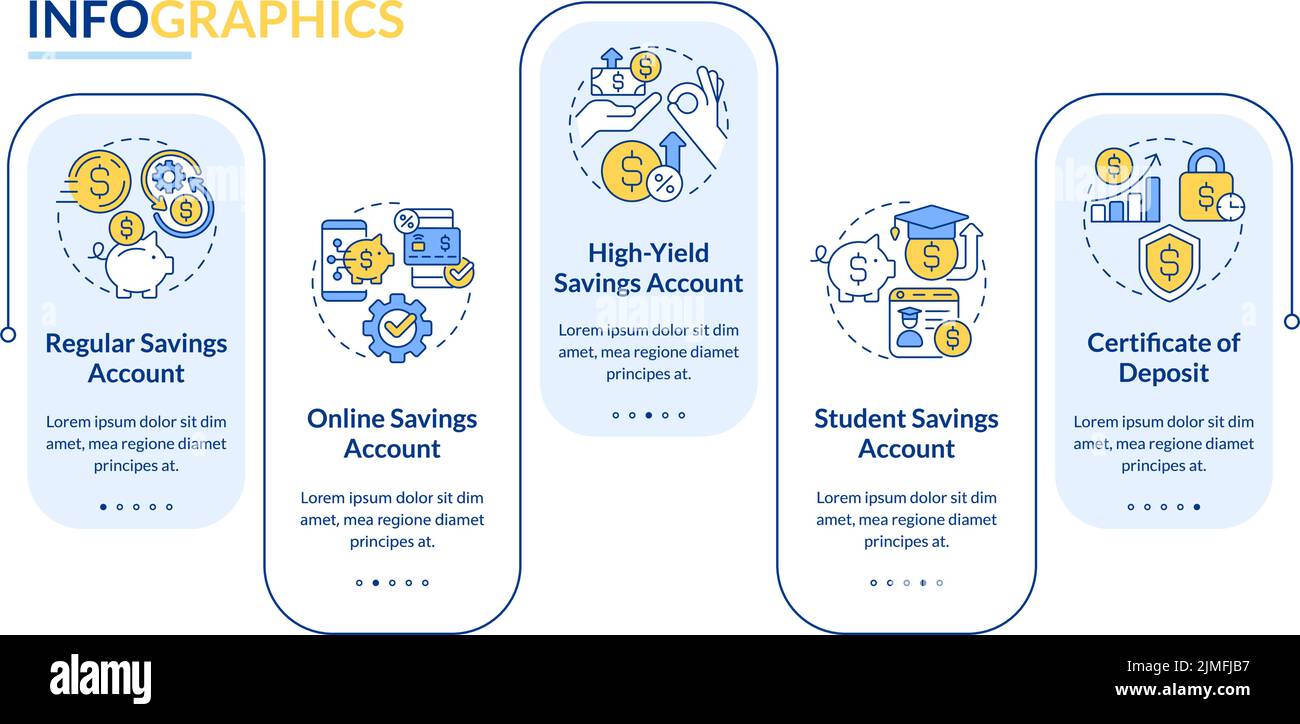

Feeling overwhelmed by the world of financial jargon? Wondering what the difference is between a high-yield savings account and a traditional savings account? You’re not alone! The financial world can seem like a labyrinth of confusing terms and complicated options, and choosing the right savings account is a crucial step in establishing your financial security.

Image: www.alamy.com

Understanding the different types of savings accounts available can empower you to make informed financial decisions that align with your goals. This guide will break down the basics, helping you navigate the world of savings accounts with confidence, so you can start building your financial future today.

Types of Savings Accounts: Unveiling the Options

Let’s start by defining what a savings account is. Simply put, it’s a safe place to stash your money where it earns interest over time. Different types of savings accounts offer varying features and benefits, catering to different needs and financial objectives.

1. Traditional Savings Accounts

Think of traditional savings accounts as the “classic” option. They’re offered by most banks and credit unions, and they provide a relatively safe and straightforward way to save your money. Here are some key features:

- Basic Interest Rates: You’ll earn a small amount of interest on your balance, but typically lower than other savings account options.

- Easy Access: You can easily deposit and withdraw money via ATM, online banking, or in person.

- FDIC Insurance: Your money is insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000, providing peace of mind.

2. High-Yield Savings Accounts (HYSA)

If you’re looking for a little extra return on your savings, high-yield savings accounts (HYSAs) are worth exploring. These accounts offer higher interest rates than traditional savings accounts, boosting your savings potential.

- Higher Interest Rates: HYSAs typically offer higher interest rates than traditional savings accounts, allowing your money to grow faster.

- Online-Only Access: HYSAs are often offered by online banks, which means you may need to access them online or through their mobile app.

- FDIC Insurance: Like traditional savings accounts, HYSAs are also FDIC-insured, ensuring the safety of your funds.

Image: www.coursehero.com

3. Money Market Accounts (MMAs)

Money market accounts offer a blend of features from savings accounts and checking accounts. They often come with higher interest rates than traditional savings accounts but may offer limited check-writing privileges.

- Higher Interest Rates: MMAs typically offer higher interest rates than traditional savings accounts but often lower than HYSAs.

- Check-Writing Privileges: They sometimes allow limited check-writing, providing more flexibility than traditional savings accounts.

- FDIC Insurance: MMAs are also FDIC-insured, ensuring the safety of your savings.

4. Certificates of Deposit (CDs)

Certificates of deposit (CDs) are a type of savings account that requires you to lock your money away for a set period of time, typically ranging from a few months to several years. In return for this commitment, you earn a higher interest rate than traditional savings accounts.

- Fixed Interest Rates: CDs offer fixed interest rates for the duration of the term, providing predictable returns on your savings.

- Fixed Term: You can’t access your money before the end of the term without penalties.

- FDIC Insurance: CDs are FDIC-insured up to $250,000, protecting your funds.

Choosing the Right Savings Account for You

Now that you have a better understanding of the different types of savings accounts, it’s time to identify the one that best aligns with your financial goals and needs. Consider these factors when making your choice:

1. Your Financial Goals

What are you saving for? Are you working towards a short-term goal like a down payment for a car, a long-term goal like retirement, or a combination of both? Your financial goals will influence the type of savings account you choose.

2. Your Risk Tolerance

How comfortable are you with potential fluctuations in the value of your savings? HYSAs and MMAs offer higher interest rates but may also carry a slightly higher risk compared to traditional savings accounts. If you’re risk-averse, a traditional savings account might be the safest option.

3. Your Time Horizon

How long are you planning to keep your money in the savings account? If you need to access your money quickly, a traditional savings account or HYSAs are good options. If you can commit to a fixed term for a higher return, a CD might be the right choice.

4. Interest Rates

Interest rates vary depending on the type of savings account and the financial institution offering it. Shop around to compare interest rates and find the best deal for your needs.

5. Account Fees and Restrictions

Some savings accounts may have monthly fees, minimum balance requirements, or restrictions on withdrawals. Carefully review the terms and conditions of any account you’re considering to avoid hidden fees or limitations.

Maximizing Your Savings

Once you’ve chosen the right savings account, there are several strategies to help maximize your savings potential:

1. Set a Savings Goal

Having a specific savings goal in mind can be a powerful motivator. Break down your goal into smaller, more manageable steps to make it feel less daunting.

2. Automate Your Savings

Set up an automatic transfer from your checking account to your savings account on a regular basis, even a small amount. This will help you build your savings consistently, even if you don’t feel like putting money aside every month.

3. Track Your Progress

Keep an eye on your savings progress and monitor your spending habits. This will help you stay on track and make adjustments as needed to reach your goals.

Compare Types Of Savings Accounts Ngpf

Conclusion

Understanding the different types of savings accounts available is crucial for young adults starting their financial journeys. By carefully comparing your options and choosing the right account for your needs, you can start building a solid financial foundation for the future. Remember to set realistic savings goals, automate your savings, and regularly track your progress to reach your financial aspirations.